Expanding Financial Inclusion by Facilitating Remittances with Mobile Technology

Research Findings

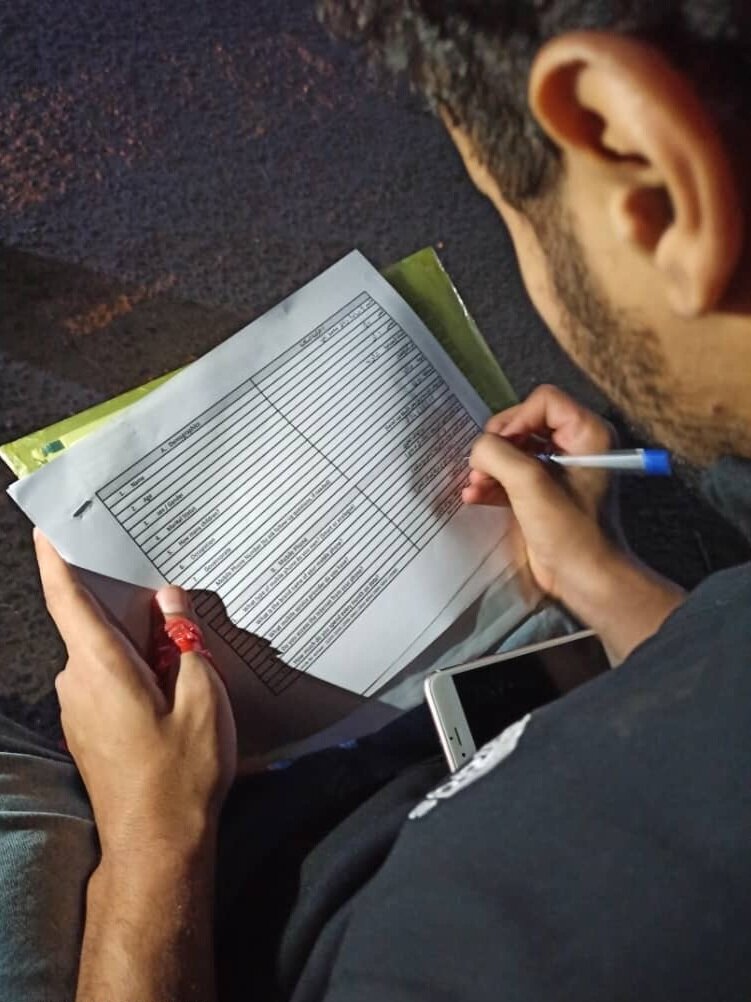

Years of civil war, COVID and climate change have left the Yemeni economy in shambles, adding more reliance on remittances and cash transfers for families to make ends meet. This ethnography attempted to shed more light on the likelihood of digital currency adoption and use by way of surveys to gauge the interest of remittance and cash transfer users.

The data below are a general summary of the surveys completed by 381 respondents from July 2020 to December 2021. The surveys were administered by two local researchers and their assistants in both northern and southern governorates.

If you would like to learn more about this project, please contact us.

Demographics

98 percent of respondents are male

28 is the average age

51 percent are married

35 percent have children

63 percent are formally employed.

Mobile Phone Usage

99 percent of respondents own a smart mobile

100 percent access the internet from their mobile

3500 Yemeni Rial is the average spent on data each month.

Remittances

2 times a month is the average respondents receive remittances

130,000 Yemeni Rials is the average received per remittance

86 percent of remittances come from Saudi Arabia

Digital Wallets

13 percent have made a purchase with their mobile

76 percent want to use their mobile to make purchases

10 percent have used their mobile to pay bills

Most respondents are interested in having a digital wallet